As the aesthetic industry continues to evolve and change, understanding consumer behavior helps us see what the next big thing in beauty and plastic surgery will be. Our 2024 State of Aesthetics report dives into the latest data, examining the impact of GLP-1 medications on beauty spending to the growing demand for noninvasive treatments. This report gives real time insights to help show which categories are growing and what’s driving consumer choices in this transitional year.

The Impact of GLP-1 Medications

One of the most significant trends in plastic surgery today is the rise of GLP-1 medications like Ozempic and Zepbound. Originally developed for diabetes management, these drugs have become popular for their weight loss benefits. However, they also bring unique aesthetic challenges, such as sagging skin and facial volume loss—commonly referred to as “Ozempic Face” and “Ozempic Body.” A large majority of respondents, 49%, stated they plan to have an in-office procedure after achieving their weight loss goals.

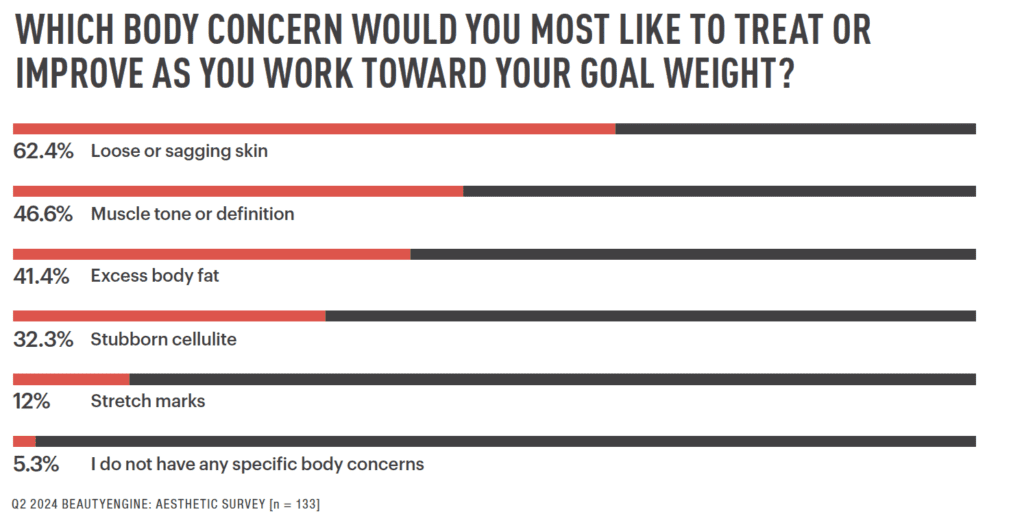

Our data shows that 62.4% of consumers who have achieved their weight loss goals with GLP-1 medications are now seeking treatments to address loose or sagging skin. Additionally, 46.6% are interested in enhancing muscle tone and definition, while 41.4% are focused on reducing excess body fat. This growing demand for skin tightening, muscle toning and body contouring treatments is evident in aesthetic practices across the country.

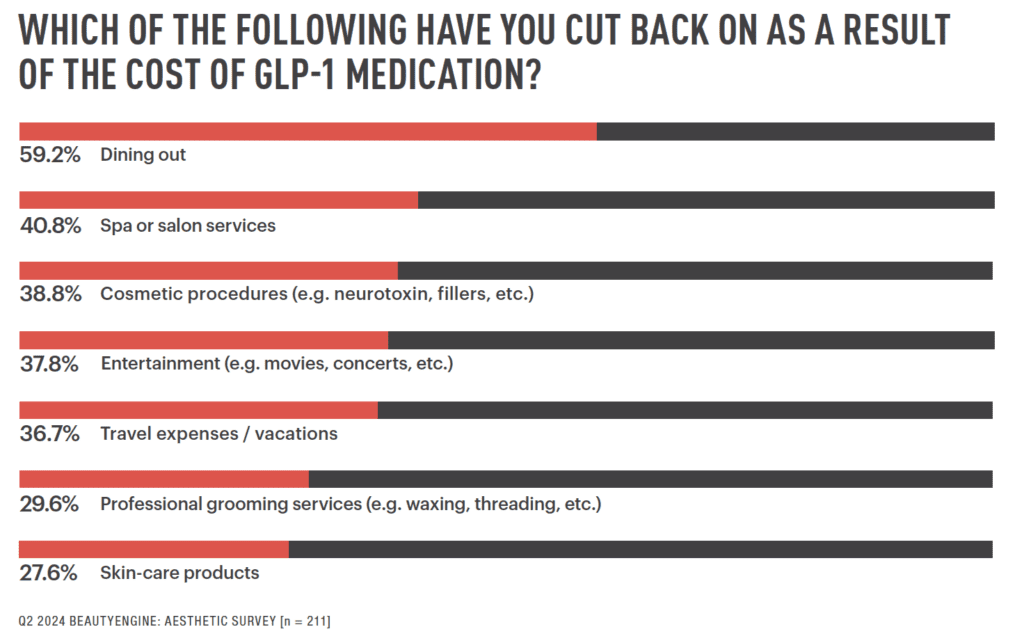

The financial commitment to GLP-1 medications is also reshaping consumer spending habits. According to our survey, 41.2% of respondents have cut back on other expenses, such as dining out and spa services, to afford these medications. Despite these sacrifices, the demand for aesthetic treatments remains robust. Consumers are increasingly seeking cost-effective solutions that deliver visible results, with minimally invasive procedures like microneedling, laser skin resurfacing and neurotoxins gaining popularity among those looking to maintain their appearance during their weight loss journey.

Evolving Consumer Preferences

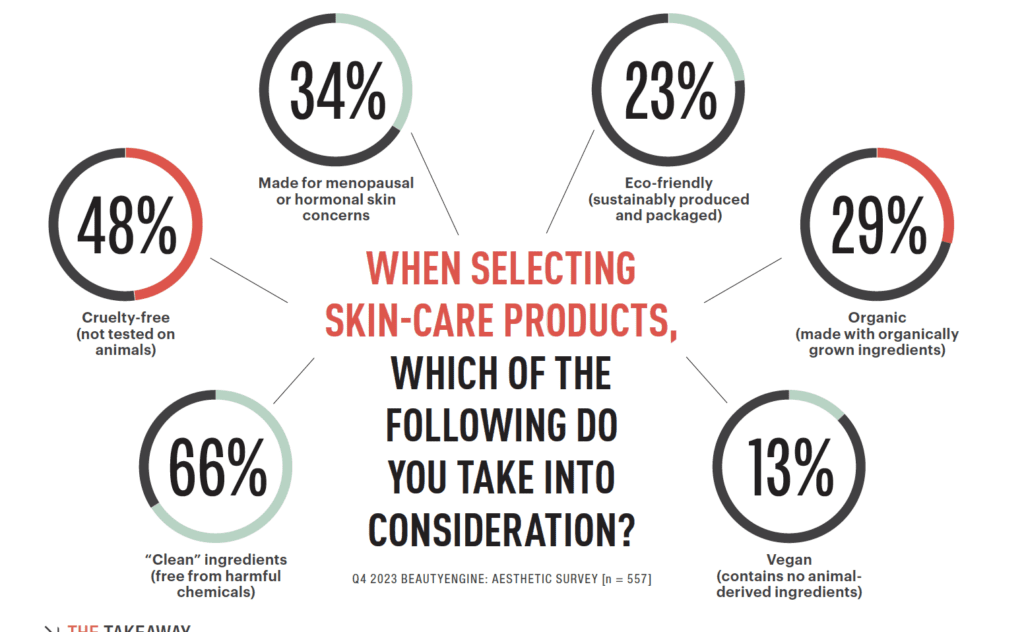

As consumers’ skin-care priorities evolve, clean ingredients, cruelty-free products and solutions for hormonal skin concerns have become top considerations. The data reveals a rising interest in organic and vegan options, reflecting a broader shift towards sustainability and ethical beauty practices. For aesthetic providers, this indicates that consumers are increasingly receptive to products aligned with these values and are willing to incorporate them into their skin-care routines. Notably, the report shows that 40% of consumers purchased skin care products directly from their aesthetic provider in the past year, highlighting the importance of offering products that resonate with these evolving preferences.

The Future of Aesthetic Treatments

Looking ahead, the demand for noninvasive and minimally invasive treatments continues to grow. Our survey reveals that 42.9% of respondents plan to undergo neurotoxin treatments, while 38.7% are interested in microneedling and teeth whitening. These preferences highlight the desire for treatments that offer significant results with minimal downtime—a trend that is likely to dominate the aesthetic industry in the coming years.

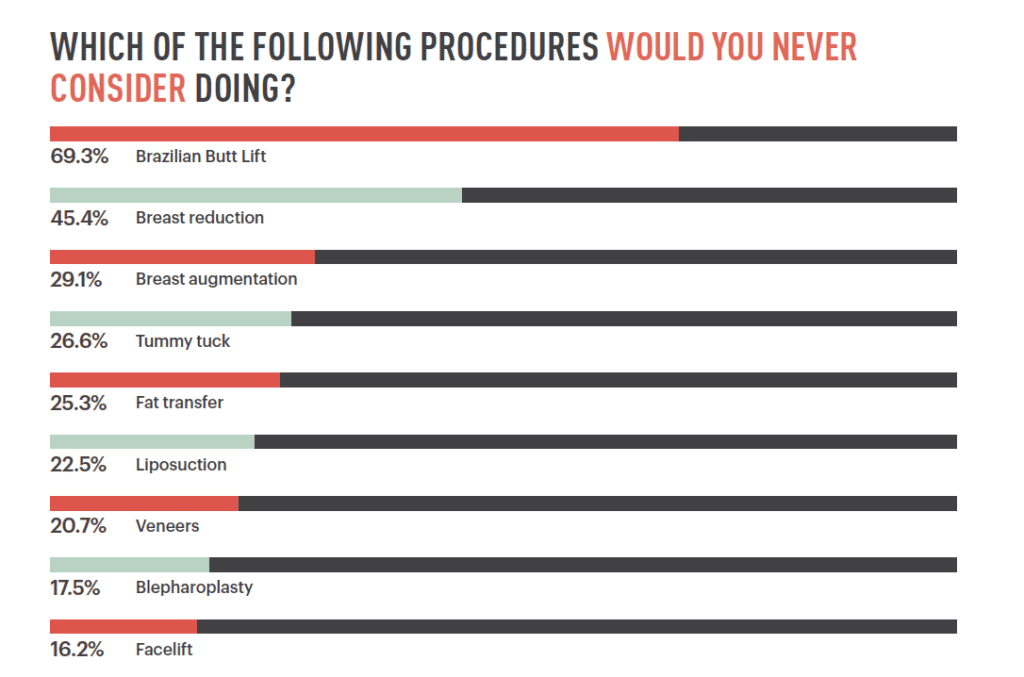

The report also reveals significant hesitations among respondents when it comes to certain cosmetic procedures. Topping the list is the Brazilian Butt Lift, with 69.3% of participants expressing they would never consider it, signaling a strong aversion to this high-risk procedure. Breast reduction and augmentation also faced notable resistance, with 45.4% and 29.1% of respondents, respectively, steering clear of these surgeries. This trend suggests a growing preference for noninvasive treatments as consumers become more cautious about the risks associated with surgical enhancements.

Future Spending Forecasts

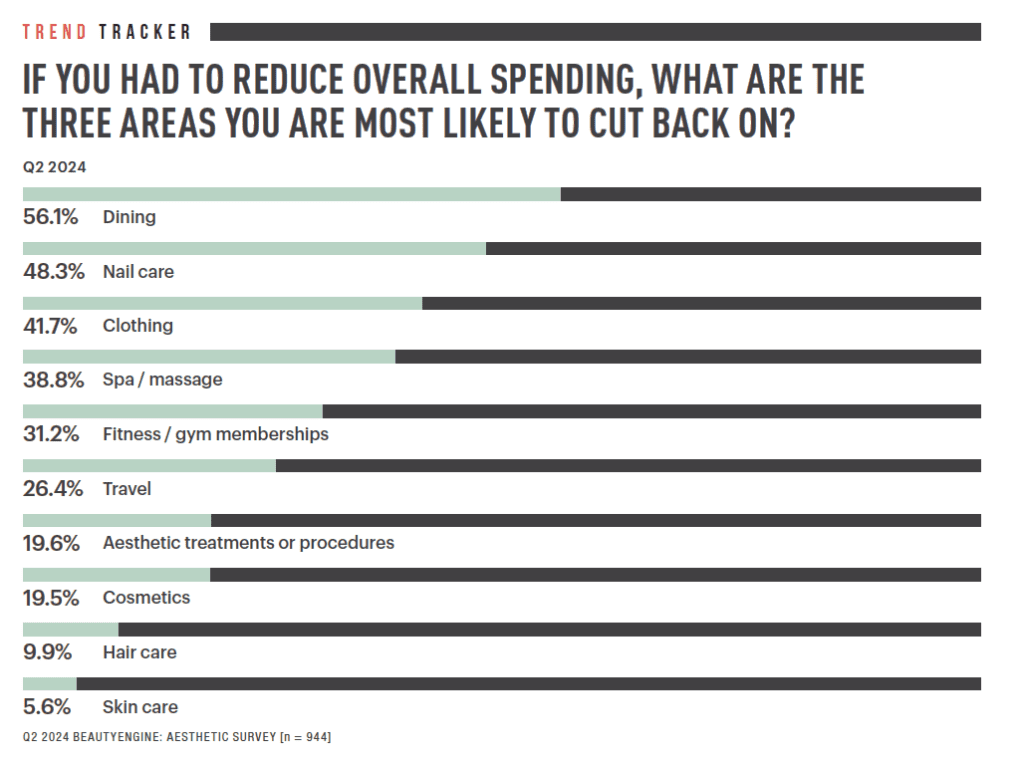

Respondents also indicated that if they needed to reduce overall spending, the top three areas they were most likely to cut back on were dining (56.1%), nail care (48.3%) and clothing (41.7%). Other areas like spa/massage services (38.8%) and fitness/gym memberships (31.2%) also saw significant potential reductions. Interestingly, spending on aesthetic treatments or procedures (19.6%) and skincare (5.6%) were among the least likely to be cut, highlighting the importance placed on maintaining beauty routines even during times of financial constraint.

As the industry continues to evolve, staying informed about these trends helps providers not only meet but also exceed client expectations, ensuring a thriving practice in 2024 and beyond.

Report Methodology: The 2024 NewBeauty “State of Aesthetics” report is based on real-time data gathered from BeautyEngine subscribers. Surveys were deployed in Spring of 2024, focusing on individual patient considerations during the aesthetic treatment process and projected spending habits and attitudes in the coming year. BeautyEngine’s extensive reach taps into a community of beauty enthusiasts with a passion for aesthetic treatments, ensuring that the report’s data accurately represents the preferences and attitudes of informed and engaged consumers. Click here for a full version of the report.